Understanding the Value of Pet Insurance for Your Furry Friends

Is Pet Insurance Worth It? When it comes to taking care of your beloved pets. One of the most important decisions you’ll face is whether or not to invest in pet insurance. As pet owners, we are dedicated to ensuring our pets’ health and happiness. But the costs associated with veterinary care can be overwhelming. From routine check-ups to unexpected emergencies, veterinary bills can quickly add up. This is where pet insurance comes into play, offering a safety net that could potentially save you a significant amount of money in the long run.

However, is pet insurance truly worth it? With so many options available in the market and varying coverage plans. It can be difficult to determine whether the cost of a policy is justified. In this article, we will explore the pros and cons of pet insurance. What it typically covers, and how to decide if it’s the right choice for you and your pet.

The Growing Importance of Pet Insurance

The idea of insuring pets has become more prevalent over the years, as people recognize the importance of safeguarding their pets’ well-being. According to recent statistics, pet insurance in the U.S. has seen a steady increase in popularity, with millions of pets covered under various plans. This growing trend speaks to the increasing awareness around the importance of preparing for unforeseen medical costs related to pets.

The rising cost of veterinary care, combined with advancements in pet healthcare, makes pet insurance even more attractive. More treatments, medications, surgeries, and diagnostics are available today for pets, but they often come with a hefty price tag. Pet insurance offers a way to manage these potential expenses and avoid financial strain when your pet requires medical attention.

Key Benefits of Pet Insurance

1. Financial Protection from Unexpected Costs

One of the most compelling reasons to invest in pet insurance is the financial protection it provides. Veterinary care for pets is not cheap, especially if your furry companion suffers from a serious illness or injury. Emergency surgeries, cancer treatments, or prolonged hospital stays can cost thousands of dollars. Pet insurance helps mitigate these high costs, ensuring that you won’t have to choose between your pet’s health and your financial well-being.

2. Access to Comprehensive Care

Pet insurance allows you to take your pet to any licensed vet or specialis. Offering a broader range of treatment options. Whether it’s routine care or a specialized procedure, having insurance allows you to make decisions based on the health of your pet rather than worrying about costs. This can be crucial if your pet needs emergency care or long-term treatment for chronic conditions.

3. Peace of Mind

Knowing that you’re financially covered in the event of a medical emergency can provide immense peace of mind. Pet owners often worry about how they will afford unexpected medical expenses, and pet insurance alleviates this burden. With insurance in place, you can focus on your pet’s recovery instead of scrambling to secure funds for treatment.

4. Customizable Plans to Fit Your Needs

Most pet insurance providers offer a variety of plans that allow you to select the coverage that best suits your pet’s specific needs. Whether you have a young, healthy pet or an older animal with pre-existing conditions, there are policies designed to provide the right level of protection. You can choose your deductible, reimbursement rate, and coverage limits to create a plan that fits both your budget and your pet’s healthcare requirements.

What Does Pet Insurance Cover and Is Pet Insurance Worth It?

The coverage provided by pet insurance can vary greatly depending on the provider and the type of plan you choose. Here are some of the common types of coverage offered:

1. Accidents and Emergencies

Most basic pet insurance plans cover accidents, injuries, and emergencies. If your pet is involved in an accident or suffers from an unexpected injury, your insurance will help pay for emergency treatment, surgeries, or hospital stays. This coverage is essential for dealing with unforeseen situations that could otherwise lead to expensive bills.

2. Illnesses and Chronic Conditions

Pet insurance can also cover illnesses such as infections, digestive disorders, and chronic conditions like arthritis or diabetes. Coverage for chronic conditions may be limited or have waiting periods, so it’s important to understand the specifics of your policy.

3. Routine and Preventative Care

Some policies offer add-ons for routine care, including vaccinations, flea and tick treatments, and annual check-ups. While not always included in basic policies, these optional extras can help you manage the costs of regular health maintenance for your pet.

4. Specialty Care and Treatments

If your pet requires specialized care or treatments, such as cancer treatment, diagnostic tests, or surgeries, pet insurance can cover these expenses. Depending on the policy, this can include access to high-cost treatments like chemotherapy or MRIs that would otherwise be unaffordable.

The Drawbacks of Pet Insurance

While pet insurance offers a range of benefits, it may not be the right choice for every pet owner. It’s important to consider both the advantages and disadvantages before making a decision.

1. Monthly Premiums

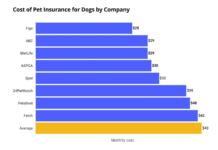

The most obvious downside of pet insurance is the cost of premiums. Depending on your pet’s age, breed, and health, monthly premiums can range from $20 to $100 or more. While this can be manageable for some, it may not be worth it for others. Particularly if your pet is generally healthy and doesn’t require frequent visits to the vet.

2. Exclusions and Limitations

Pet insurance policies often come with exclusions, such as pre-existing conditions, cosmetic procedures, or certain breeds that are prone to genetic issues. You’ll need to read the fine print to ensure that your pet’s specific needs are covered. Additionally, many policies have limits on how much they will pay out per year or per condition, which could leave you with significant out-of-pocket expenses.

3. Deductibles and Co-pays

In addition to the monthly premiums, you may also need to pay a deductible before the insurance kicks in. Some plans also require co-pays, where you’re responsible for a percentage of the treatment costs. This means that, while your pet’s care may be partially covered, you’ll still need to cover a portion of the bill.

4. Uncertain Long-Term Costs

For pets that live long lives, you may end up paying more in premiums over the years than the actual cost of the medical care your pet receives. While pet insurance provides valuable protection in the event of an emergency. It’s important to weigh the ongoing costs against the likelihood of needing extensive care.

How to Decide if Pet Insurance is Right for You

Choosing whether or not to invest in pet insurance depends on various factors. Here are some things to consider when making your decision:

1. Your Pet’s Age and Health

If you have a young, healthy pet, you may not require as much coverage as someone with an older pet or a pet prone to health issues. However, purchasing insurance while your pet is young can often result in lower premiums and fewer exclusions for pre-existing conditions.

2. Your Budget and Financial Situation

Consider your ability to cover unexpected veterinary costs. If you have the financial means to handle emergency expenses without assistance, you may not need insurance. However, if you would struggle to afford treatments in the event of an emergency, pet insurance could be a worthwhile investment.

3. Your Pet’s Breed and Predispositions

Certain breeds are more prone to genetic conditions or health issues, which could lead to higher veterinary bills down the road. If your pet belongs to a breed that is prone to specific illnesses. insurance may provide you with the peace of mind needed to afford necessary treatments.

4. The Cost of Veterinary Care in Your Area

If you live in an area where veterinary care is expensive, pet insurance can help offset these costs. It may also be worth comparing the cost of insurance premiums with the potential costs of treatment for common conditions in your area.

Final Thoughts on, Is Pet Insurance Worth It

When weighing whether pet insurance is worth it. It’s important to carefully assess your pet’s needs, your financial situation, and the level of coverage provided by various plans. While the monthly premium and exclusions might seem daunting. The protection and peace of mind that pet insurance offers could be invaluable in the event of a medical emergency.

For many pet owners, the value of knowing that they can provide the best possible care for their pets without worrying about financial constraints makes pet insurance a worthwhile investment. However, as with any decision. It’s important to do your research, compare policies, and choose the best option for both you and your furry friend.