Pet insurance is an essential financial tool for ensuring that your pet receives the best possible care during accidents or illnesses. How Much Is Pet Insurance? The cost of pet insurance depends on several factors, such as the type of pet, its breed, age, location, and the coverage options you select. Learning about these costs helps pet owners make informed decisions when choosing the best protection for their furry companions.

Factors That Influence the Cost of Pet Insurance

Type of Pet

The species of your pet significantly impacts insurance premiums. Dogs usually cost more to insure than cats, and rarer animals often have limited options for coverage, leading to higher prices.

Breed

Some breeds are predisposed to specific health problems, which increases insurance costs. For instance, larger dog breeds may face risks such as joint issues, while certain cat breeds are prone to respiratory conditions.

Age

The age of your pet is another determining factor. Younger pets tend to have lower premiums because they are less likely to suffer from chronic conditions. As pets grow older, the risk of illnesses rises, leading to higher insurance rates.

Location

Where you live affects the price of veterinary care, which in turn impacts insurance costs. Urban areas or regions with higher living expenses generally have higher premiums.

Coverage Options

Comprehensive plans covering accidents, illnesses, and routine care cost more than accident-only policies. Additional features, such as dental or behavioral therapy, further increase premiums.

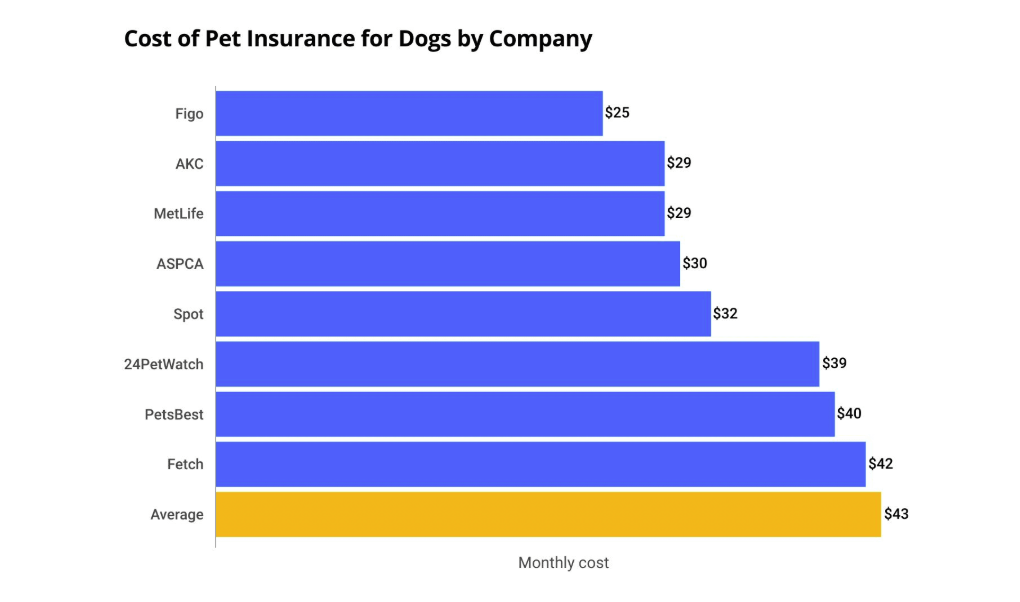

Average Costs of Pet Insurance

Understanding average premiums can help set realistic expectations for pet insurance expenses.

- Accident and Illness Coverage: This is the most common plan. For dogs, monthly premiums average $56, while cats typically cost $32.

- Accident-Only Coverage: More affordable but limited in scope, these policies cost about $17 per month for dogs and $10 for cats.

- Add-On Wellness Plans: Adding preventive care coverage may increase monthly premiums by $10 to $20.

Finding the Right Plan: How Much is Pet Insurance?

Choosing the best insurance plan involves balancing your pet’s needs with your budget.

Assess Coverage Needs

Consider the health risks associated with your pet’s breed and age. A young, healthy pet may benefit from a basic policy, while an older animal with pre-existing conditions may require comprehensive coverage.

Optimize Your Budget

Opt for a plan with a deductible and reimbursement level that fits your financial capacity. Higher deductibles lower monthly premiums but increase out-of-pocket costs for claims.

Compare Policies

Take the time to evaluate multiple policies to find one that suits your needs. Pay attention to what each policy includes, such as coverage limits, waiting periods, and exclusions.

Why Invest in Pet Insurance?

Pet insurance provides financial security for unexpected medical costs. From injuries to chronic diseases, veterinary care can be expensive. Insurance ensures you won’t have to compromise on your pet’s health.

For example, treating conditions like ligament tears or diabetes can cost thousands of dollars annually. With the right coverage, these expenses are partially or fully reimbursed, making it easier to manage.

Final Thoughts

Pet insurance offers peace of mind and ensures you can focus on your pet’s well-being. Although the cost varies depending on your pet’s specifics, the investment is invaluable for those who want to provide the best care possible. Whether you need a basic or comprehensive plan, understanding the costs and benefits will help you choose the right option for your beloved pet.